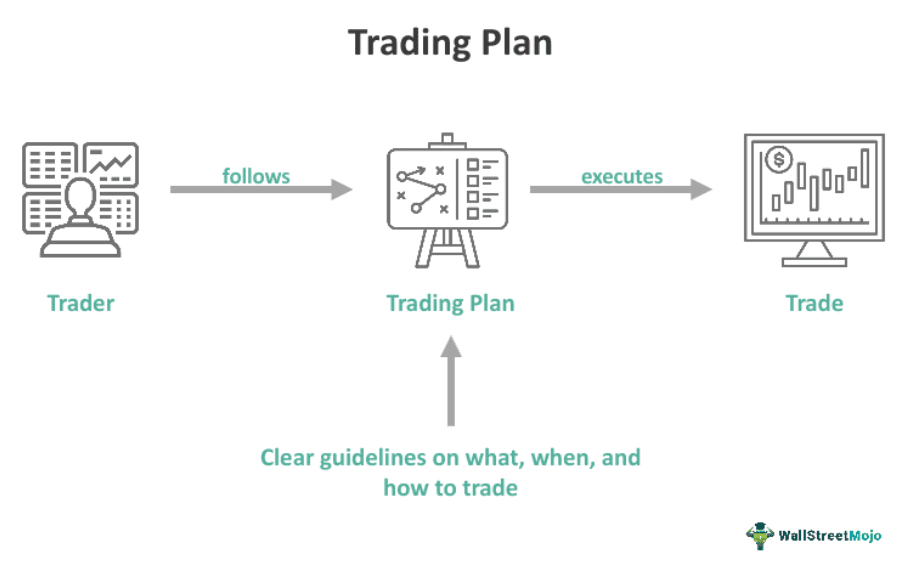

Planing is important for trader

Ji haan, planning ek successful trader ke liye behad zaroori hai. Ek achi trading plan banane aur us plan par amal karne ke kuch faiday hain:

- Risk Management:

- Trading plan banane se pehle aapko apne risk tolerance ko aur har trade ke liye kitna risk lena hai, ye decide karna hoga. Isse aap apne nuksanat ko control mein rakh sakte hain.

- Entry and Exit Strategy:

- Trading plan mein aapko saaf taur par entry aur exit points define karne chahiye. Kaise aur kab trade karna hai, ye plan banake rakha jata hai.

- Position Sizing:

- Achi trading plan mein aapko yeh bhi decide karna hoga ke har trade mein kitna position size lena hai. Over-leverage se bachne ke liye sahi position sizing bahut zaroori hai.

- Market Analysis Approach:

- Trading plan aapko ye bhi batayega ke aap kaunsi market analysis techniques ka istemal karenge – fundamental, technical, ya kisi aur ki. Ye approach aapke trading decisions ko guide karega.

- Trading Timeframe:

- Aapko decide karna hoga ke aap kaunsa timeframe prefer karte hain. Kuch traders short-term trading karte hain, toh kuch long-term. Aapki trading plan aapke chosen timeframe ke hisab se bana hoga.

- Emotion Control:

- Achi trading plan, aapko trading ke dauran emotions ko control mein rakhne mein madad karega. Emotion-driven trading se bachne ke liye predefined rules aur strategies ka hona important hai.

- Regular Review and Improvement:

- Trading plan ko banane ke baad bhi, aapko apne plan ko regular intervals par review karna chahiye. Market conditions badalte rehte hain, isliye aapka plan bhi flexible hona chahiye aur aapko zarurat padne par use update karna chahiye.

- Consistency:

- Achi trading plan aapko consistency maintain karne mein madad karega. Aap apne strategies ko systematic taur par follow kar payenge.

- Learning from Mistakes:

- Trading plan, aapke mistakes se seekhne mein bhi madad karega. Aap apne trades ko analyze karke, kyun aur kaise nuksan hua, isko samajh sakte hain aur apne plan mein necessary changes kar sakte hain.

- Goal Setting:

- Achi trading plan aapke trading goals ko bhi define karega. Aapko pata chalega ke aap kis tarah ke returns expect kar sakte hain aur kitne time mein.

Is tarah se, achi trading plan banane se aap apne trading journey ko organized taur par manage kar sakte hain aur better results achieve kar sakte hain.

تبصرہ

Расширенный режим Обычный режим